I have a Hotel Business. Suppose a corporate booking comes in with a company GSTIN and is through MakeMyTrip with a GSTIN too. How can we input all these into Tally Prime? It's too confusing. GSTR-1 and GSTR-3B must show all the necessary tax related numbers, billwise entry to keep track of which booking are paid by MMT. I did sales entry for Corporate booking (Hotel Gross Charges to company with taxes). But problem starts with commission based? I had MakeMyTrip (Sundry Creditors), Commission Expenses (Indirect Expenses), TDS, TCS (Duties & Taxes) created, but got confused how to do all the entries.

Example : Company "ABC" Hotel Gross Charges : 2075, GST (12%) : 249, Total Charges: 2324, MMT Commission : 414.96, GST on commission (18%) : 74.69, Total Commission : 489.65, TCS (0.5% of 2075) : 10.38, TDS (0.1 of 2075) : 2.08, MMT to Pay Hotel (Total Charges - Total Commission - TCS - TDS): 1821.89.

Please provide the solution for this. If possible, a small video will be appreciated.

Please refer below MakeMyTrip transaction flow in TallyPrime as per my best knowledge;

1. Sales will be posted under your MakeMyTrip ledger only because TDS and TCS will be deducted for MakeMyTrip and you will going to receive your payouts from MakeMyTrip only and not from the end customer

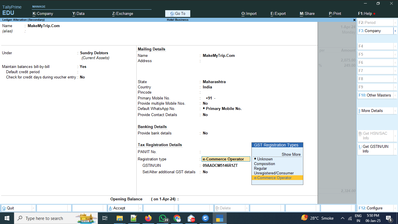

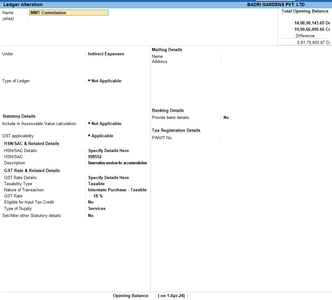

Create MakeMyTrip ledger as an e-Commerce Operator in your TallyPrime as shown in below snapshot;

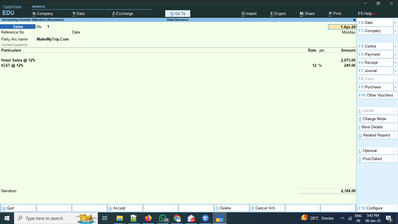

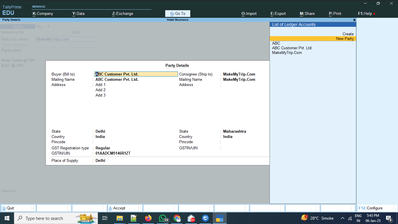

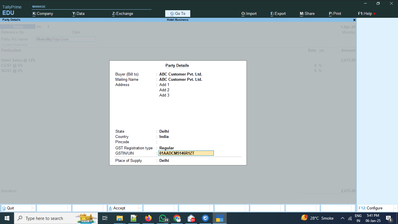

2. While recording sales via MakeMyTrip, TallyPrime will allow you to enter actual end customers details along with their GSTIN that will ultimately shown in your GSTR1

Choose option "New Party"

This will not going to be created as a customer in your books because you are not going to get the payment from him

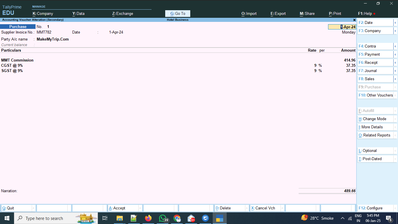

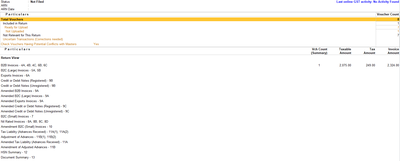

3. Now record MakeMyTrip commission entry like this and this will reflect in your GSTR2B

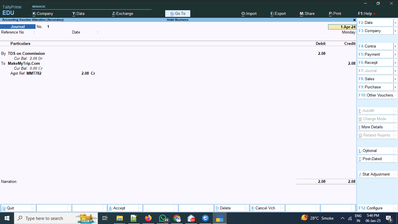

4. Now record MakeMyTrip TDS deducted entry like this

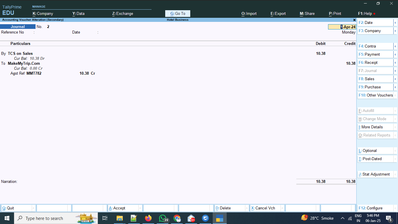

5. Now record MakeMyTrip TCS deducted entry like this

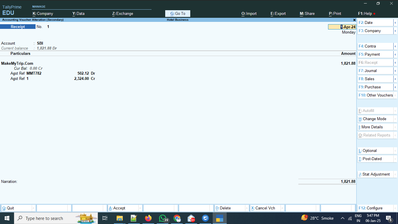

6. Now record payment to be received from MakeMyTrip like this

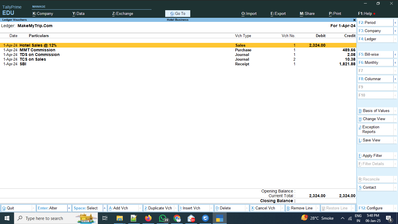

This is how your MakeMyTrip ledger will look like in TallyPrime;

With this you will get more idea about MakeMyTrip accounting in TallyPrime.....I suggest you create a dummy data and check all the parameters and make changes according to your requirements before go live

Regards,

Dhaval Goradia

Thanks a lot. MakeMyTrip shows error when created under e-Commerce Operator, but works with Regular Type. All steps are working and checked. But some issues in GSTR Reports. GSTR-1 is fine.

1. Please share the screenshots of all the ledger created, TDS, TCS, MMT Commission and Others so I can replicate them. Like auto calculation of TDS, TCS and others. Too many ledger entries is happening.

2. GSTR-3B reports shows ITC reversed.