Notifications

Clear all

TDS in Tally

5

Posts

2

Users

0

Reactions

623

Views

Topic starter

04/11/2024 8:05 pm

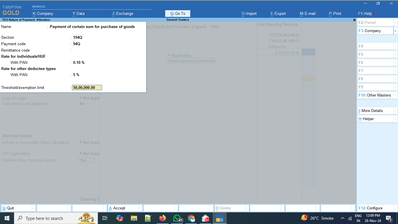

"Set Calculate tax on value exceeding the threshold/exemption limit to Yes".

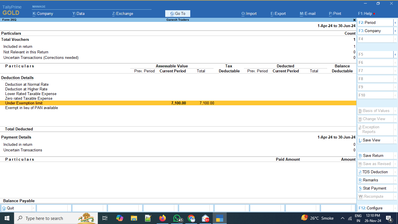

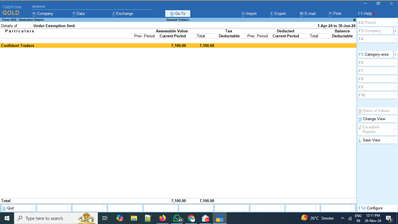

Even after activating this option, it deducts TDS on the amount less than 50 lakhs for 194Q.

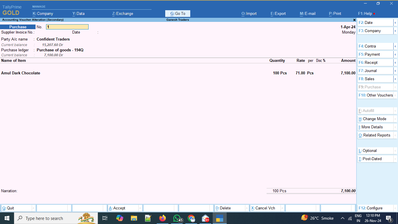

Supplies started from 1st April, it reached the threshold limit in November this year, but the TDS due balance shows in 26Q right from the beginning.

Kindly advise..

Tally Version

14/11/2024 5:41 pm

Yes....according to TDS rules....TDS to be deducted on entire amount within financial year if it crosses the exemption limit.

You may talk to your CA whether this deduction is right or no.

Regards,

Dhaval Goradia

Topic starter

15/11/2024 5:53 pm

Thanks for your reply..

The notification clearly says, amount exceeding 50 lakhs to be taken on account for TDS deduction.

My problem is not with the LAW but with tally software..